- We are a manufacturer of oil press equipment and grain and oil processing equipment.

- Email:2334065214@qq.com

Nigeria’s history as Africa’s largest potential palm oil producer has been that of a global leader in the palm oil industry, but current production accounts for less than 2% of the global total. With the government’s goal of increasing annual palm oil production from 600,000 tons to 5 million tons by 2027, and the backdrop of a sustained rise in international palm oil prices, the establishment of a small-scale palm oil mill in Nigeria has become an investment that combines both policy dividends and market potential. The following is a systematic analysis of the cost components in five dimensions: land, equipment, operation, policy and market risk.

Land and Infrastructure Costs

The Nigerian government plans to invest US$500 million in the expansion of the palm oil industry, but the acquisition of land still needs to be negotiated by investors. Taking Lagos State as an example, the lease price of agricultural land is about 200-300 US dollars per hectare per year, and small factories need at least 5 hectares of land for raw material storage and processing, with an annual rent of about 1,000-1,500 US dollars. Additional investment is needed for infrastructure construction:

Road hardening: the cost of hardening a 500-meter dirt road connecting to the main road is about US$50,000;

Electricity supply: configuring a 50kVA diesel generator set and a backup fuel tank costs about US$30,000;

Water system: drilling of a well and construction of a water storage tank costs about US$20,000.

II. Equipment Purchase and Installation Costs

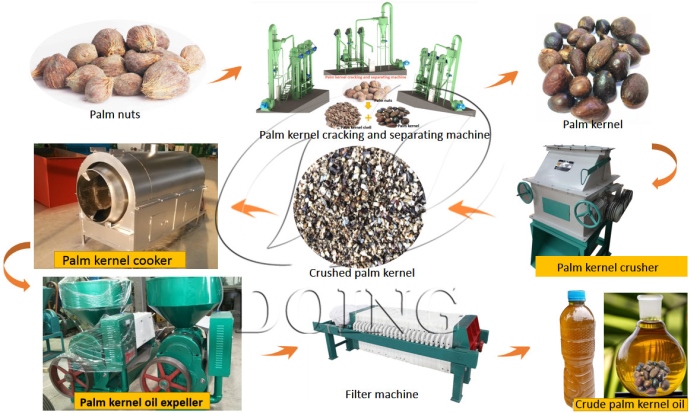

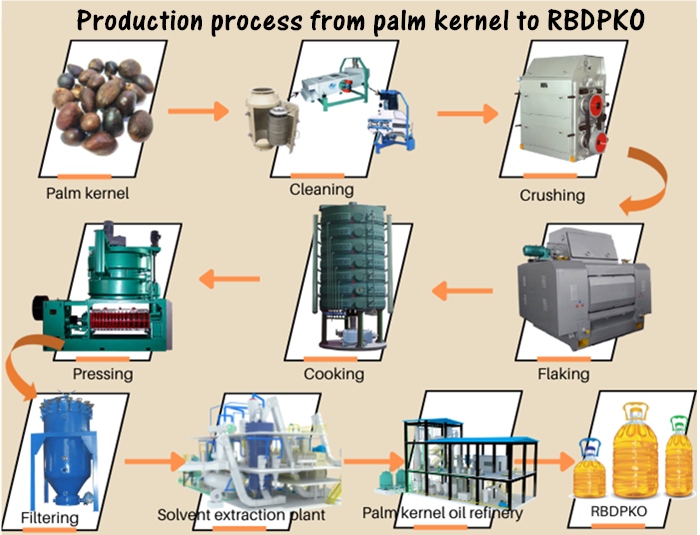

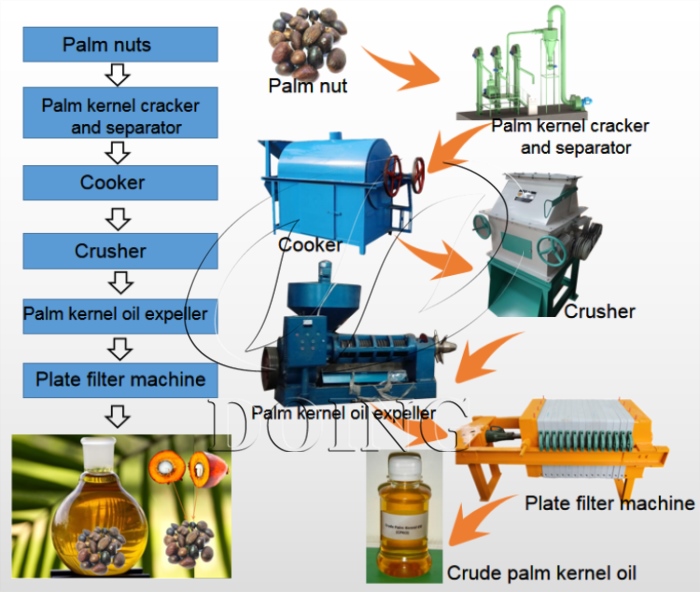

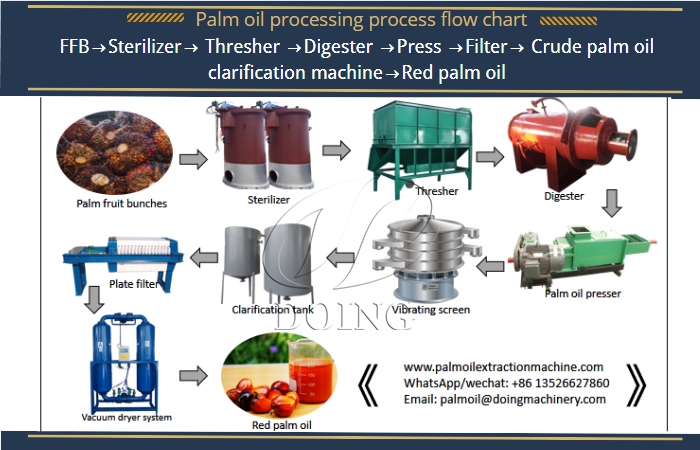

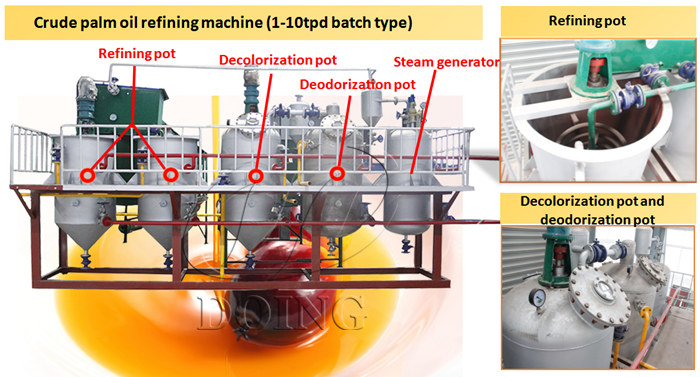

The core equipment of a small palm oil mill includes a fruit bunch crusher, a press, a refining tank and an oil storage tank. Take the capacity of processing 50 tons of fruit bunches per day as an example:

Domestic equipment: Chinese-made small and medium-sized crushing lines (including refining equipment) are quoted at about US$500,000-US$800,000, and installation and commissioning costs are about US$100,000;

Used equipment: the price of second-hand equipment phased out in Southeast Asia can be lowered to US$300,000-US$500,000, but it needs to bear the risk of refurbishment and transportation;

Environmental protection facilities: about US$150,000 for the wastewater treatment system and the fume purification device to meet Nigerian environmental protection standards.

Operation and labor cost

Raw material procurement: the market price of fresh fruit bunches (FFB) in Nigeria is about 50-80 naira/kg, about 100 tons of bunches are needed to process 50 tons per day, and the daily cost is about 5-8 million naira (about 6,000-10,000 U.S. dollars).

Labor cost: the monthly salary of skilled workers is about 300-500 U.S. dollars, and the monthly expenditure of a team of 10 people is about 3,000-5,000 U.S. dollars. 000 USD;

Energy consumption: diesel generator consumes about 200 liters of oil per day, costing about 150 USD, with a monthly expenditure of about 4,500 USD;

Logistics cost: transportation cost from origin to factory is about 0.1 USD/ton-km, and if the factory is located 100 km away from raw material place, the daily transportation cost is about 500 USD.

Policies and Compliance Costs

Taxes: Nigerian corporate income tax is 30%, but agricultural enterprises can enjoy 5-year tax exemption; value-added tax (VAT) is 7.5%, but agricultural exports are exempted;

Permits: palm oil processing license processing cost is about US$2,000, and the environmental protection assessment report is about US$5,000;

Subsidies: projects in line with the government’s industrial planning can apply for a low-interest loan (with interest rate about 8%), or equipment import tariff reductions. , or import tariff exemption for equipment (up to 50%).

V. Market Risks and Profitability Measurement

Price Fluctuation: Malaysian palm oil futures price exceeds RM4,200/ton in 2025 (~US$940), but local Nigerian gross palm oil price is usually 10%-15% lower than the international market;

Competitive Pressure: The global palm oil giant, PZ-Wilmar, has invested US$650 million in Nigeria, and small-scale mills need to differentiate themselves from the competition by focusing on organic certification or high value-added products (e.g., organic oil), or by focusing on the production of high value-added products (e.g., organic oil). or high value-added products (e.g. palm kernel oil);

Payback cycle: based on a daily production of 5 tons of refined palm oil (ex-factory price of about US$1,200/ton), annual revenue of about US$2.19 million, net profit of about US$500,000-800,000 after deducting costs, and payback period of about 5-7 years.

VI.CONCLUSIONS AND RECOMMENDATIONS

The total investment for establishing a small palm oil mill in Nigeria is about US$1.5-2.5 million, of which the equipment purchase accounts for the highest proportion (40%-50%). Investors need to focus on:

Raw material supply chain: signing long-term purchase agreements with local farmers to lock in price and supply;

Policy developments: closely tracking government subsidy policies and export tariff adjustments;

Technology upgrades: introducing smart crushing and refining technologies to increase oil yield to over 20% (industry average 18%-19%);

Market diversification: developing regional markets in Africa and reducing dependence on European exports.

As the global demand for sustainable palm oil grows, small mills with RSPO certification may take the lead in the revitalization of Nigeria’s palm oil industry.

gao

Henan Zhongrui Grain is a high-tech enterprise specializing in the research, development, manufacture and sales of oil press equipment, and has been deeply engaged in the field of oil processing for more than ten years. The company integrates design, production and testing, and its products cover screw oil press, hydraulic oil press, automatic refining production line, etc., which are suitable for rapeseed, peanut, soybean, sesame and other oilseeds, and help customers to realize efficient, energy-saving and environmentally friendly oil and grease production.

Contact Us

Product Center

menu

Recommended

© 2025. All Rights Reserved. 豫ICP备19039166号 Theme By XinTheme